It refers to the efficiency or profitability of an investment, relative to the investment’s cost.

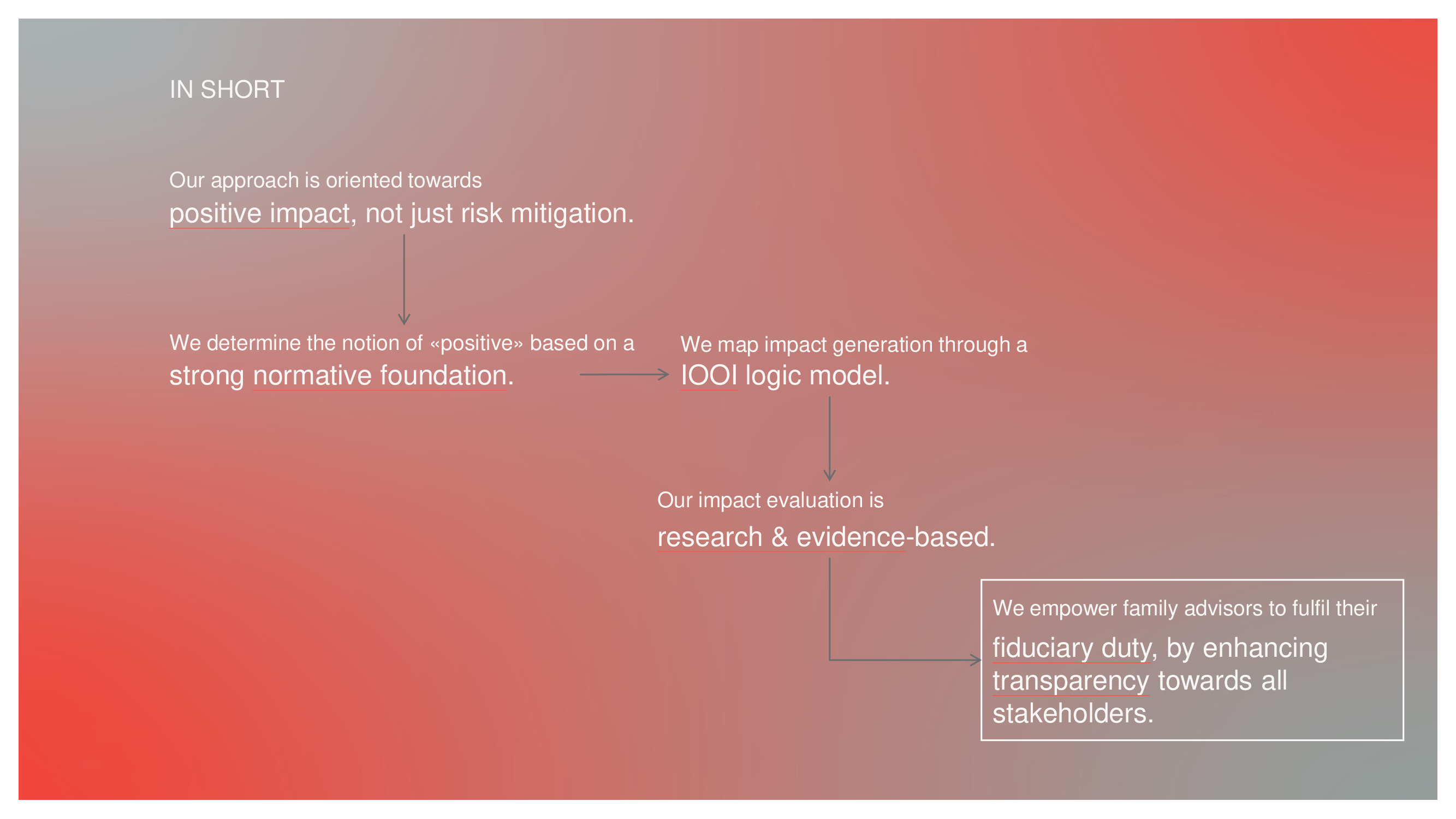

Based on the holistic understanding of investment and returns, Fondazione AIS is developing a Comprehensive Wealth Management Methodology, to enable positive impact selection choices of the allocation of all resources instead of negative risk mitigation only. The integrated Wealth Management Methodology is at the core of all activities to advance impact and sustainability.

It refers to the efficiency or profitability of an investment, relative to the investment’s cost.

It refers to the value produced for multiple stakeholders in all three dimensions of development: economic, social and environmental. The relation between the returns may vary, but any investment decision implies all three aspects.